Hermès Reclaims Top Spot in Luxury Bag Resale Value for 2025

According to Rebag's 2025 Clair Report, Hermès has reclaimed its position as the leader in luxury handbag resale value retention, achieving an average of 138%. This represents a significant 38% year-over-year increase. The report, analyzing millions of data points, highlights the enduring investment potential of top luxury brands in the secondary market, with Goyard, Miu Miu, and The Row also showing strong performance. The findings underscore a defining year for luxury resale, driven by higher primary prices and shifting consumer behavior.

The luxury resale market continues to demonstrate remarkable resilience and growth, with iconic brands proving their worth as long-term investments. According to the latest industry analysis from Rebag, 2025 has been a pivotal year, marked by significant shifts in brand performance and consumer demand. The New York-based resale platform's annual Clair Report provides crucial insights into which luxury items retain—and even increase—their value over time, offering a clear guide for collectors and investors alike.

Rebag's comprehensive study, which analyzes millions of data points across primary and secondary markets, positions the luxury resale sector as a stable and increasingly vital component of the broader fashion economy. The report suggests that global factors, including tariff shifts and evolving consumer priorities, have made 2025 a "defining year for luxury resale." This analysis is essential for understanding the tangible value behind luxury goods beyond their initial retail appeal.

Hermès Leads with Unmatched Value Retention

In a standout finding, Hermès has decisively reclaimed the top position for bag resale value retention in 2025. The brand achieved an impressive average value retention rate of 138%, which signifies that its bags are selling on the secondary market for 38% more than their original retail price on average. This marks a substantial 38% increase in retention value compared to the previous year, solidifying Hermès's status as the premier investment brand in handbags.

The report's decade-long analysis of the iconic Birkin bag reveals an even more compelling story. Since 2015, Birkin resale values have skyrocketed by 92%, dramatically outpacing the brand's own retail price growth of 43% over the same period. This data underscores the exceptional long-term appreciation potential of Hermès's most coveted pieces, making them a unique asset class within the luxury landscape.

Competitive Landscape and Other Top Performers

While Hermès leads the pack, other luxury houses also demonstrated robust value retention, highlighting a competitive and healthy resale ecosystem. French trunk-maker Goyard secured a strong second place, logging 132% average retention in 2025—a 28% increase from its 2024 performance. This consistent growth indicates sustained desirability and brand strength.

The report also noted significant gains for other brands. Miu Miu climbed to an average retention rate of 104%, while The Row recorded a solid 97%. This tiered performance illustrates that investment potential exists across a spectrum of luxury brands, though the highest returns remain concentrated with the most historically prestigious names.

Broader Implications for the Luxury Market

The findings from Rebag's Clair Report signal several key trends for the wider luxury industry. Charles Gorra, CEO and founder of Rebag, noted that "higher primary prices pushed more consumers to the secondary market, reaffirming its stability." This shift indicates that as retail prices for new luxury goods continue to rise, the pre-owned market becomes an increasingly attractive and financially sensible alternative for consumers.

Furthermore, the report highlighted renewed collector interest in specific styles and eras. The return of the Louis Vuitton x Takashi Murakami collaboration boosted search demand, pushing top styles above 130% of their original retail value. Similarly, early-2000s bags from Balenciaga (Le City), Celine (Phantom), and Chloé (Paddington) saw a surge in demand, pointing to cyclical trends and the enduring appeal of vintage designs.

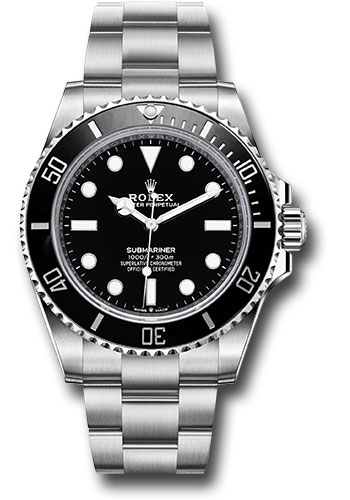

The analysis extended beyond handbags, offering insights into adjacent luxury categories. In fine jewellery, Van Cleef & Arpels extended its lead with 112% retention, driven notably by its Sweet Alhambra collection. In watches, Rolex remained steady at 104% average retention, with standout models like the Submariner 'Hulk' reaching an astonishing 244% of their original retail price. In contrast, Cartier watches witnessed 87% retention.

Conclusion: A Stable and Growing Secondary Market

The 2025 Clair Report from Rebag paints a clear picture of a luxury resale market that is not only stable but thriving. Hermès's reclaiming of the top spot, with a dramatic 38% year-over-year increase in value retention, confirms the unparalleled investment quality of its products. The strong performance of other brands indicates a broad-based strength in the sector.

For consumers, the data reinforces the idea that certain luxury purchases can be viewed as assets with the potential for appreciation. For the industry, it highlights the growing importance and integration of the secondary market, a trend further evidenced by Rebag's own launch on Luxury Stores at Amazon in 2024. As primary prices climb and consumer behavior evolves, the resale market is poised to remain a defining and dynamic force in the global luxury landscape.