Watches of Switzerland Sees 15% US Sales Surge, Defying Luxury Headwinds

The Watches of Switzerland Group has reported a significant 15% increase in US sales for the first half of its fiscal year, driven by resilient demand for high-end timepieces. This growth comes despite broader economic uncertainties and initial tariff threats between the US and Switzerland. The US market remains the company's core profit driver, accounting for nearly 60% of its total profitability. The article examines the factors behind this strong performance, including strategic inventory management by brand partners and a favorable revision to proposed tariffs.

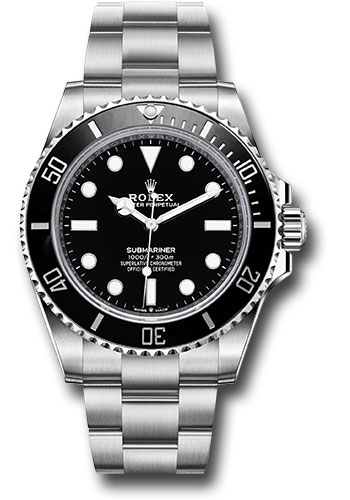

The luxury watch sector is demonstrating remarkable resilience, with the Watches of Switzerland Group (WOSG) posting a robust 15% surge in US sales for the six months ending October 26. This performance underscores the enduring appeal of high-end timepieces among American consumers, even as the global luxury market navigates a complex economic landscape. The retailer's success is anchored in its strategic focus on the US, which serves as its most critical market, and its portfolio of iconic brands like Rolex, TAG Heuer, and Audemars Piguet. This analysis delves into the key drivers behind this growth and the external factors, such as international trade dynamics, that are shaping the company's trajectory.

Strong US Performance as a Core Profit Driver

The United States is not just a market for Watches of Switzerland; it is the engine of its profitability. According to the company's reports, the US accounts for almost 60% of the group's total profitability. For the first half of the year, US sales climbed to £409 million (approximately $545.52 million), a significant increase from £355 million in the same period last year. This growth outpaced the broader luxury goods market, which Bain & Company forecasts will grow 3–5% next year, driven in part by strong US momentum. The company's performance indicates a deep and sustained demand for luxury watches, positioning it favorably against market expectations.

Navigating Tariff Uncertainties

A significant backdrop to this financial period was the trade tension between the US and Switzerland. The US had initially threatened to impose tariffs as high as 39% on Swiss goods, which would have directly impacted watch imports. However, a mid-November trade deal reduced this potential levy to 15%. The US is Switzerland's top foreign watch market, accounting for almost 17% of its watch exports, making these negotiations critically important. Watches of Switzerland stated it welcomed the reduced tariffs. Interestingly, the company reported seeing no significant change in consumer behavior following the introduction of the initial tariff threats, suggesting that its affluent customer base may be less price-sensitive.

Strategic Inventory Management

A key factor that insulated the company from potential tariff impacts was proactive planning by its brand partners. In September, Watches of Switzerland noted that its suppliers had built up inventory ahead of the anticipated tariffs. This strategic stockpiling effectively shielded the retailer's first-half performance from any negative financial impact. This move highlights the close collaboration within the luxury watch supply chain and the ability of major brands to manage logistical challenges to protect retail partners and maintain market stability.

Market Reaction and Future Outlook

The financial markets responded positively to the sales update, with the company's shares initially rising as much as 3.8% to 494 pence. While the gains moderated later in the trading day, the initial spike reflects investor confidence in the company's US-focused strategy and its ability to deliver growth. The strong first-half results position Watches of Switzerland well as it moves into the crucial holiday season. The company's performance, against the backdrop of a revised tariff landscape and sustained consumer demand, suggests a stable outlook for its operations in its most important market.

In conclusion, Watches of Switzerland's 15% sales jump in the US is a testament to the strength of the luxury watch category and the company's effective market strategy. By leveraging its dominant position in the US, navigating trade policy shifts, and benefiting from supportive brand partners, the group has demonstrated robust operational resilience. As the global luxury market continues its measured growth, Watches of Switzerland's performance highlights the sector's ability to thrive on brand desirability and strategic agility.