UK Christmas Shopping Forecast: £23 Billion Festive Spending Expected

British consumers are projected to spend nearly £23 billion on festive products during the 2025 Christmas season, according to VoucherCodes' annual forecast. The report indicates a 2.5% increase in festive-specific spending compared to previous years, with total retail spending expected to reach £91.12 billion across the six-week holiday period. This represents one of the strongest growth rates among major European economies, highlighting continued consumer confidence despite economic challenges.

As the holiday season approaches, retail analysts are closely watching consumer spending patterns, with new data suggesting a robust Christmas shopping period ahead for UK retailers. According to the latest forecast from voucher and discount specialist VoucherCodes, British consumers are expected to spend nearly £23 billion specifically on festive products during the crucial six-week period leading up to Christmas.

Overall Retail Spending Projections

The broader retail picture reveals even more significant numbers, with total UK retail spending projected to reach £91.12 billion between November 17 and December 31. This represents a 3.2% increase compared to previous years, positioning the UK as one of Europe's strongest performing markets during the festive season. According to the VoucherCodes report, only Spain is expected to outperform the UK with a projected 3.8% growth rate, though its total spending volume remains significantly lower at the equivalent of £26.86 billion.

European Market Comparisons

The UK's projected performance stands in contrast to other major European economies. Germany is forecast to see a 2.4% increase in retail spending to £74.78 billion, while France anticipates a modest 1.1% growth reaching £62.86 billion. Italy trails with only 0.8% projected growth to £37.75 billion. The Netherlands and Belgium complete the European picture with expected increases of 3% and 1.9% respectively.

Gifting Dominates Festive Spending

Within the £22.94 billion dedicated to festive-specific purchases, gifting emerges as the dominant category. Consumers are projected to spend £11.59 billion on gifts alone, accounting for 50.5% of all festive purchases. This represents a significant turnaround from recent years, with gifting sales expected to increase by 2.1% in 2025 after only achieving 0.8% growth in 2024 and experiencing declines in the two preceding years.

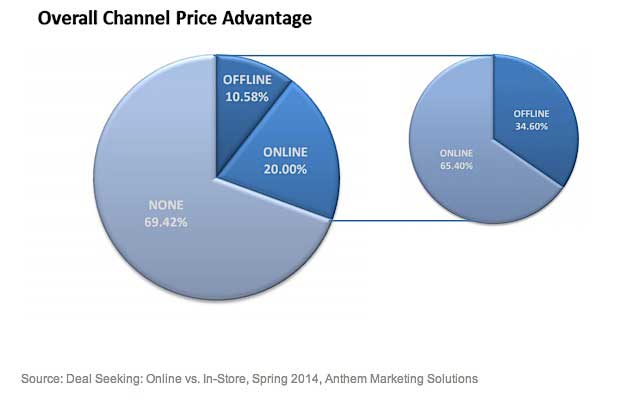

Online vs Offline Shopping Trends

The continuing evolution of consumer shopping habits is evident in the projected channel split. Online sales are forecast to grow by 4.7% to £34 billion, significantly outpacing the 2.3% growth expected for physical stores. However, despite the stronger growth rate for e-commerce, traditional retail continues to dominate the Christmas shopping landscape. Physical stores are projected to account for 62.7% of all Christmas retail spend, representing £57.1 billion in sales.

Additional Festive Expenditure

Beyond traditional retail, consumers are also expected to increase spending on festive holidays by 1.8% to £2.36 billion. This additional expenditure may provide a secondary boost to retail sectors such as fashion and beauty as consumers prepare for seasonal travel and celebrations. The combination of gifting, decorations, holiday spending, and general retail indicates a comprehensive festive economy that extends beyond simple product purchases.

Market Implications and Consumer Confidence

The projected growth rates, while positive, still fall below current inflation levels, suggesting that consumers remain price-conscious despite their willingness to spend. The data from VoucherCodes indicates a cautious optimism among UK shoppers, with spending increases reflecting both pent-up demand and careful budget management. Retailers will need to balance competitive pricing with quality offerings to capitalize on this projected spending surge.

As the holiday season approaches, these forecasts provide valuable insights for retailers planning their inventory, marketing strategies, and staffing levels. The continued strength of physical retail, combined with growing online sales, suggests that omnichannel strategies will be crucial for maximizing holiday revenue. The UK's position as a leading European retail market during the festive period underscores the importance of understanding these consumer trends for both domestic and international retailers operating in the British market.