Record High Home Insurance Premiums: Key Factors Driving US Rate Increases

Home insurance premiums across the United States are reaching unprecedented levels due to multiple converging factors. Climate change impacts, increased natural disasters, rising construction costs, and broader economic inflation are creating a perfect storm for homeowners facing significantly higher insurance bills. Understanding these drivers helps homeowners better navigate the changing insurance landscape and make informed decisions about their coverage needs.

Home insurance premiums across the United States have reached record highs, creating financial challenges for homeowners nationwide. Multiple converging factors are driving these unprecedented rate increases, from climate-related risks to broader economic pressures. This comprehensive analysis examines the primary drivers behind the rising costs and what homeowners can expect in the current insurance market.

Climate Change and Natural Disaster Impacts

The increasing frequency and severity of natural disasters represent one of the most significant factors driving insurance premium increases. Insurance companies are facing unprecedented payouts due to hurricanes, wildfires, floods, and other weather-related events. These catastrophic events have forced insurers to reassess risk models and increase premiums to maintain financial stability. The growing pattern of extreme weather events has created uncertainty in risk assessment, leading to more conservative pricing strategies across the industry.

Rising Construction and Repair Costs

Construction material costs and labor expenses have surged dramatically, directly impacting insurance premiums. When insurers calculate coverage needs, they must account for the actual cost of rebuilding homes after damage or destruction. The increased costs of lumber, steel, concrete, and skilled labor mean that insurers must charge higher premiums to ensure they can cover potential claims. This cost inflation affects both property damage coverage and liability protection components of home insurance policies.

Economic Inflation and Market Conditions

Broader economic inflation has contributed significantly to rising insurance premiums. As the cost of living increases across all sectors, insurance companies face higher operational expenses, including employee costs, technology investments, and administrative overhead. These increased business costs are inevitably passed on to consumers through higher premium rates. Additionally, investment returns that insurers rely on to offset claim costs have been affected by volatile market conditions, further necessitating premium adjustments.

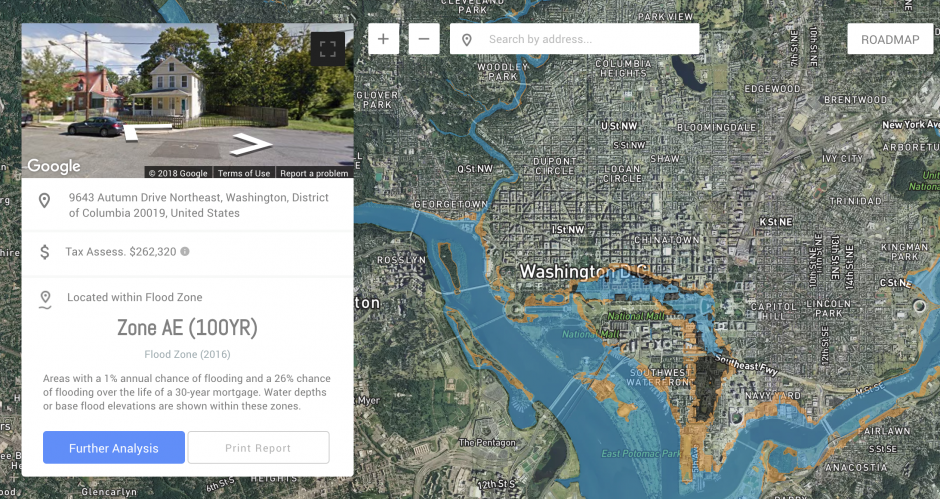

Regional Variations and Risk Assessment Changes

Insurance premium increases are not uniform across all regions. Areas with higher exposure to specific risks, such as coastal regions vulnerable to hurricanes or western states prone to wildfires, are experiencing more substantial rate hikes. Insurance companies are using more sophisticated risk assessment tools and data analytics to price policies according to specific geographic risks. This targeted approach means homeowners in high-risk areas may see disproportionately higher premium increases compared to those in lower-risk regions.

Future Outlook and Homeowner Considerations

The trend of rising home insurance premiums is likely to continue as climate risks persist and economic factors remain volatile. Homeowners should proactively review their coverage needs, consider higher deductibles to lower premiums, and explore available discounts for home safety features. Regularly comparing insurance options and maintaining good credit can also help mitigate some of the financial impact. Understanding these driving factors empowers homeowners to make informed decisions and potentially identify cost-saving opportunities within their insurance arrangements.

As the insurance market continues to evolve, staying informed about these trends and maintaining open communication with insurance providers will be crucial for homeowners navigating this challenging environment. While premium increases may be unavoidable in many cases, strategic planning and risk management can help minimize the financial burden on American households.