Mortgage Rates Hit Multi-Year Lows: The Pros and Cons for October Homebuyers

October brings historically low mortgage rates that present significant opportunities for homebuyers, but understanding the complete picture is crucial. While lower rates mean reduced monthly payments and increased purchasing power, buyers should also consider market competition, potential bidding wars, and the importance of thorough financial preparation. This analysis examines both the advantages and challenges of current mortgage conditions to help buyers make informed decisions in today's unique housing market environment.

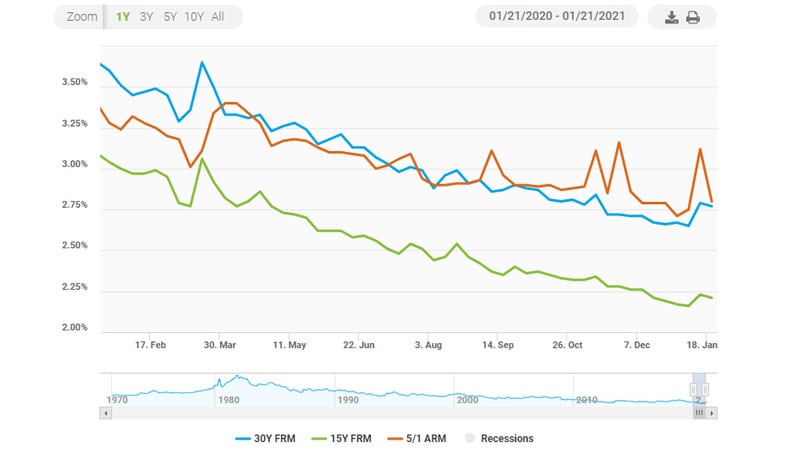

October's mortgage landscape presents a rare opportunity for prospective homebuyers, with rates reaching levels not seen in years. While this development offers significant financial advantages, it's essential to understand both the benefits and potential drawbacks before making one of life's most important financial decisions.

The Advantages of Current Mortgage Rates

Lower mortgage rates translate directly into substantial monthly savings for homebuyers. A reduction of just half a percentage point can save tens of thousands of dollars over the life of a 30-year loan. This financial relief makes homeownership more accessible to a broader range of buyers and can significantly impact household budgets.

Increased purchasing power represents another key benefit. When rates drop, buyers can qualify for larger loan amounts while maintaining the same monthly payment. This expanded buying capacity opens up opportunities in higher-priced neighborhoods or for properties with more desirable features that might have been previously out of reach.

Important Considerations for October Buyers

While the financial benefits are clear, buyers should approach the current market with realistic expectations. Increased competition often accompanies favorable rate environments, as more buyers enter the market simultaneously. This heightened demand can lead to bidding wars and faster decision-making requirements.

Thorough financial preparation remains crucial regardless of rate conditions. Buyers should ensure their credit scores are optimized, down payment funds are readily available, and all necessary documentation is organized. The speed of today's market demands that qualified buyers can move quickly when they find the right property.

Strategic Approaches for Today's Market

Successful navigation of the current mortgage environment requires a balanced approach. Buyers should work with reputable lenders to lock in favorable rates while maintaining realistic expectations about property availability and pricing. Pre-approval becomes even more critical in competitive markets.

Long-term financial planning should guide decision-making rather than short-term rate advantages. Consider how today's purchase fits into your overall financial picture and whether the timing aligns with your personal and professional goals. The right home purchase should support your broader life objectives.

Making Informed Decisions

October's attractive mortgage rates present genuine opportunities for qualified buyers, but they're just one factor in the homebuying equation. Careful consideration of personal financial readiness, market conditions, and long-term goals will lead to the most successful outcomes.

By understanding both the advantages and challenges of the current environment, buyers can make confident decisions that align with their financial objectives and lifestyle needs. The combination of favorable rates and thoughtful preparation creates the foundation for successful homeownership.